LIC New Jeevan Shanti is a deferred annuity plan offered by Life Insurance Corporation (LIC) of India. The plan provides policyholders with a guaranteed stream of income in their retirement years. The plan offers several annuity options to choose from. The annuity rates under this plan are guaranteed and based on the age of the annuitant.

Effective from January 05, 2023, the annuity rates for LIC New Jeevan Shanti Plan (Plan no. 858) have been revised. This plan is a single premium plan that offers policyholders the option to choose between a Single life and Joint life deferred annuity.

This plan is specifically designed for working professionals and self-employed individuals who want to plan for regular income in the future after a deferment period. Additionally, it is also suitable for those who have surplus funds and are looking for investment options. As a deferred annuity plan, this plan is ideal for young professionals who want to plan for their retirement from an early stage.

Eligibility Conditions

Here are the eligibility criteria for LIC Jeevan Shanti Plan:

| Parameters | Criteria for Eligibility |

| Minimum Entry Age | 30 years (completed) |

| Maximum Age of Entry | 79 years (completed) |

| Minimum Vesting Age | 31 years (completed) |

| Maximum Vesting Age | 80 years (completed) |

| Minimum Deferment Period | 1 year |

| Maximum Deferment Period | 12 years (subjected to the vesting age) |

| Minimum purchase price | Rs 1.5 Lakh subject to the minimum annuity |

Benefits of LIC Jeevan Shanti Plan

The benefits of LIC Jeevan Shanti Policies are not limited to the ones previously mentioned. Here are a few additional benefits that are also offered by this plan.

Annuity Payment :

The annuitant can get the annuity or pension payment at various intervals regardless of the plan one takes. The policyholder can get the annuity payments at his/ her intervals on monthly, quarterly, half-yearly or yearly frequency.

Death Benefit:

The deferred annuity plan under LIC Jeevan Shanti offers a benefit that is payable in case of the annuitant’s death.

Policy Loan :

After the completion of three months from the issuance of the policy or the expiration of the free-look period, whichever is later, the policyholder can avail loans against their LIC Jeevan Shanti annuity plans. In case of Joint Life Policies, the Primary Annuitant can avail of the loan. In the absence of the Primary Annuitant, the Secondary Annuitant can do so.

The maximum amount of loan that can be granted under this policy will be such that the annual interest amount effectively payable on the loan does not exceed 50% of the annuity amount payable under the policy.

Free Look Period:

LIC Jeevan Shanti Plans provide a free look-up period of up to 15 days, during which the policyholder can review the policy’s terms and conditions. If the policyholder is dissatisfied with the terms and conditions, they can return the policy, stating the reason for their dissatisfaction. However, it should be noted that the free look-up period only applies to the purchase of a new Deferred Annuity Plan.

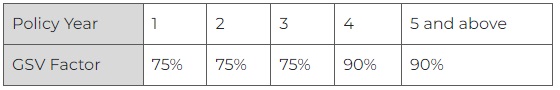

Surrender Value:

At any point during the policy term, the policyholder has the option to surrender their policy. The Surrender Value of the policy will be the higher value between the Guaranteed Surrender Value and the Special Surrender Value.

GUARANTEED ANNUITY RATES AT THE INCEPTION OF THE POLICY

Annuity rate with example

Mr. Pradip Kumar, who is 50 years old, wishes to buy the Jeevan Shanti Plan (858) in March 2023 with an investment amount of Rs. 25,00,000 as a single premium. The annuity rates for different pension payment modes and different deferment terms available to him are mentioned below.

Name of the annuitant : Pradip Kumar

Plan : Jeevan Shanti (858)

Annuity Option : Deferred annuity for Single life

Age :50

Purchase Price : 25,00,000 + GST

| Deferment Period Yrs | Yearly Pension ₹ | Half Yearly Pension ₹ | Quarterly Pension ₹ | Monthly Pension ₹ |

| 12 years | 3,41,000.00 | 1,67,151.00 | 82,738.00 | 27,300.00 |

| 10 years | 3,02,875.00 | 1,48,470.00 | 73,493.00 | 24,250.00 |

| 8 years | 2,66,625.00 | 1,30,708.00 | 64,703.00 | 21,350.00 |

| 5 years | 2,17,375.00 | 1,06,575.00 | 52,759.00 | 17,410.00 |

| 3 years | 1,96,875.00 | 96,530.00 | 47,788.00 | 15,770.00 |

| 2 years | 1,83,125.00 | 89,793.00 | 44,454.00 | 14,670.00 |

| 1 year | 1,70,375.00 | 83,545.00 | 41,362.00 | 13,650.00 |

Frequently Asked Questions

To purchase LIC Jeevan Shanti Plan, the policyholder must provide the following types of documents:

Address Proof – This can include a driving license, passport, voter card, Aadhar card, etc.

Identity Proof – Your identity proof can be a PAN Card, Aadhar card, passport, etc.

The rate of GST (Goods and Services Tax) for single premium annuity plan, such as LIC Jeevan Shanti, is 1.8% of the premium amount.

Tax benefit on premium payments: Premium payments made towards the policy may qualify for tax deductions under Section 80C of the Income Tax Act, subject to the overall limit of Rs. 1.5 lakhs. The pension received from this product is taxable according to the individual’s tax slab.

No, there is no upper limit.

I’ve been exploring pension plans for my retirement, and this article has introduced me to LIC’s New Jeevan Shanti Pension Plan. The range of annuity options and the guaranteed returns make it a compelling choice

I’m impressed with LIC’s New Jeevan Shanti Pension Plan. The article provides a clear overview of its features and benefits, making it easier for individuals like me to consider this plan for a secure and stress-free retirement

It’s great to see LIC offering a pension plan that caters to different retirement needs. The New Jeevan Shanti Pension Plan’s provision for both immediate and deferred annuities makes it a versatile solution

Retirement planning can be complex, but this article simplifies the features of LIC’s New Jeevan Shanti Pension Plan. The flexibility it offers in terms of annuity choices and the guaranteed returns are attractive

I am 58 years old person , getting retired in 2 years. Please let me know the difference between jeevan shanti and PMVVY plan.

PMVVY is a government-backed pension scheme that offers a guaranteed pension for 10 years, while Jeevan Shanti is a single premium pension plan that provides deferred annuity options with a death benefit. Both plans have their own unique features, and the choice between the two should be made based on the individual’s requirements and preferences.

What is the maximum limit for investment in lic jeevan shanti?

There is no upper limit on the premium amount that can be invested in the plan. It is recommended that you consult with an LIC agent to get detailed information on the maximum investment limit for your specific case.

I have invested in Jeevan Shanti plan couple of months back. I have a question about life certificate. Do I need to submit the LIC certificate? What is the easiest way to submit? Please let me know.

To submit a life certificate to LIC, policyholders have several options. One of the easiest ways to submit a life certificate is by visiting the nearest LIC branch office and submitting it in person. Policyholders can also submit their life certificates through the online portal of LIC or through the mobile app. To submit the life certificate online, policyholders need to log in to the LIC portal or mobile app. Alternatively, policyholders can also submit their life certificates through the post by sending a hard copy to the LIC office. It is important to ensure that the life certificate is submitted well in advance to avoid any disruptions in the payment of pension or annuity.

As someone who is preparing for retirement, I’m grateful for the information provided in this blog. LIC’s New Jeevan Shanti Pension Plan, with its customizable annuity options, is an appealing choice for securing one’s future

Retirement planning is a critical part of financial well-being. LIC’s New Jeevan Shanti Pension Plan offers a diverse range of annuity options and the assurance of guaranteed returns, making it a strong contender for retirees

Financial security during retirement is a top priority, and LIC’s New Jeevan Shanti Pension Plan offers a range of annuity options to suit various needs. This flexibility is commendable

Planning for retirement is crucial, and LIC’s New Jeevan Shanti Pension Plan appears to be a valuable choice. The article clearly outlines the plan’s features and benefits, making it easier for individuals to consider this option for their financial future

I appreciate the detailed information provided in this blog about LIC’s New Jeevan Shanti Pension Plan. The guaranteed returns and the variety of annuity options are appealing, catering to different retirement needs

The LIC New Jeevan Shanti Pension Plan seems like a comprehensive solution for securing one’s retirement. The flexibility it offers in choosing between immediate and deferred annuities makes it a versatile option